China Bitcoin OTC Report: 100mln USD Traded Over 3 Platforms in Fortnight

30 Oct, Beijing-Right before exit of most Bitcoin Exchanges in China, IFCERT released a report on OTC trade against CNY. Over 680 million yuan worth of trading are observed on 3 platforms in 2 weeks. The report disclose statistics concerning volume etc. Surprisingly, Coincola, a HK-based OTC platform, accounts for 70% of the trading volume, overtaking localbitcoins and paxful. Below is the full text translation.

As an important link in the ecosystem of bitcoin and other cryptocurrency, the exchange between Bitcoin and fiats plays an vital role. Usually, the trading could be divided into exchange-trading and OTC-trading. Bitcoin OTC trading has a longer history than exchange trading. OTC trading does not require a fixed place, a permission-based membership or a strict rules system. In most cases, it’s peer-to-peer transaction through private negotiation. IFCERT has conducted monitoring work over recent OTC trading and the following report is compiled.

1. Types of OTC

Bitcoin OTC trading could be categorized as follows: online P2P, online B2C and offline trading.

1.1 Online P2P

Online P2P transactions are generally conducted through LocalBitcoins, CoinCola and other OTC trading platforms. This type of website offers Bitcoin buyers and sellers a platform to exchange information and its model is similar to the “Taobao” model: buyers and sellers trades BTC based on the information displayed on the platform. The specific flow is as follows.

User Registration: Both sides register on the platform and fill in corresponding information, generally they are not required to do real-name authentication.

Release trading information (Ads): Both parties publish Buy or Sell information on the platform. The seller must deposit bitcoin to the platform. The platform act as a middleman from the transaction and charge a certain percentage of fee from each successful trade.

Trade Lock-in: similar to the “Taobao” model, the buyer enter a certain amount of Bitcoin that he wish to buy then the platform will freeze corresponding amount of Bitcoin from the seller’s balance.

Payment: According to the mutually-agreed payment method, the buyer pays the seller and provides proof of payment. There are plenty of payment options: bank transfer, cash remittance, third party payment, gift cards and so on. Alipay, WeChat and bank transfer are the most popular payment option for BTC-CNY trade.

Confirm receipt of payment: After confirming receipt of payment, the seller press the release button and the platform automatically releases Bitcoin to the buyer.

1.2 Online B2C Trade

Users can buy or sell Bitcoin directly with the platform. Bitcoin price is specified by the platform. After receiving the user’s payment, the platform will directly release Bitcoin to the buyer’s account. Or release funds to the seller’s account after receiving Bitcoin. Bitcoin or funds on the B-side funds are from the platform or cooperative partners.

1.3 Offline Trade

Buyers and sellers negotiate online or offline through online chat tools such as QQ group, wechat group, Telegram group, Slack group, or face to face talk.

2. OTC trading platform

After the regulatory policy was released in September, domestic OTC platforms like Bitkan and BTCT gradually exited the market. At present 4 OTC platforms that domestic users used most frequently are all located abroad. They are LocalBitcoins, Paxful, CoinCola and BitcoinWorld. OTC platforms are often not an subject to national boundary, which means they are open to all users in the world. For example, LocalBitcoins was founded in 2012, supporting 248 countries, and has users from more than 15,000 cities, including RMB users.

In terms of CNY payment methods among CNY dealers, the monitoring results show that since 2017, 96.3% of the BTC-CNY tradings on Paxful are paid via Alipay with 2.7% by WeChat and 0.56% by Itunes gift card. A sample monitoring on LocalBitcoins found that 57% of the sellers chose payment by Alipay, followed by bank transfer, accounting for 28%. Similar monitoring in CoinCola’s found that 85% of the sellers chose payment by Alipay, followed by bank transfer, accounting for 12%.

3. OTC Trade Volume

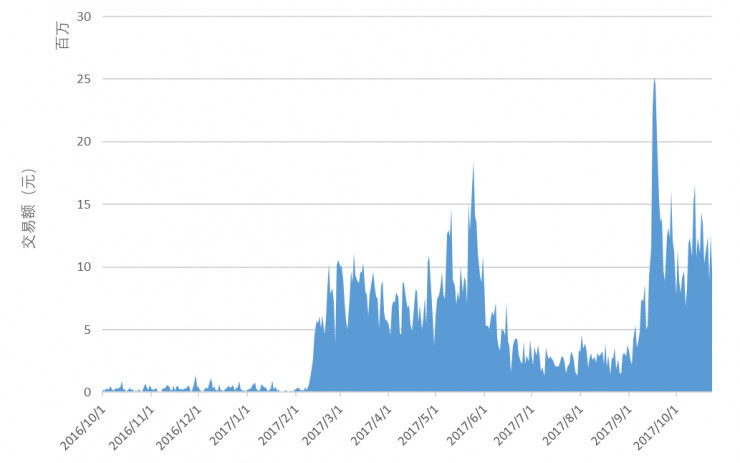

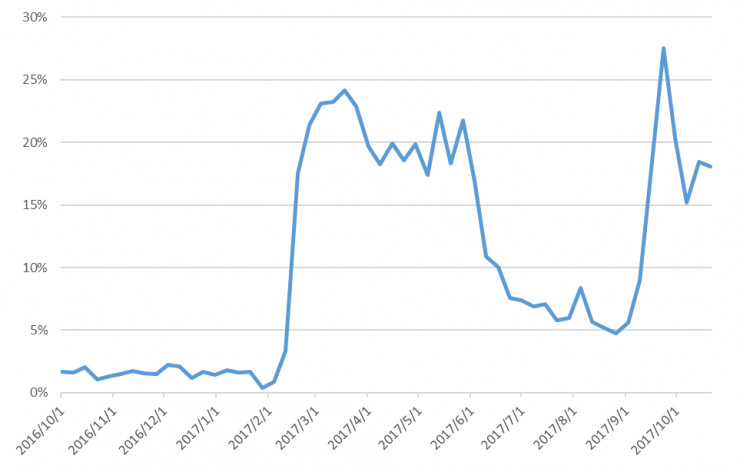

The scale of BTC-CNY OTC is shown in Figure 1 (data from LocalBitcoin and Paxful). It can be found that OTC trade volume before February 2017 is relatively small. After the exchange banned bitcoin withdrawal in early Feb, the trading volume grew exponentially. Then the volume dropped as exchange allowed withdrawal after June 2017. With the ICO ban and policy change in early September, OTC transactions once again prosper. From the data of LocalBitcoin and Paxful, the ratio of BTC-CNY volume rose from 5% to 20% among the total volume, which is shown in Figure 2.

Figure 1 BTC-CNY Daily Trading Volume

Figure 2 BTC-CNY OTC trading volume

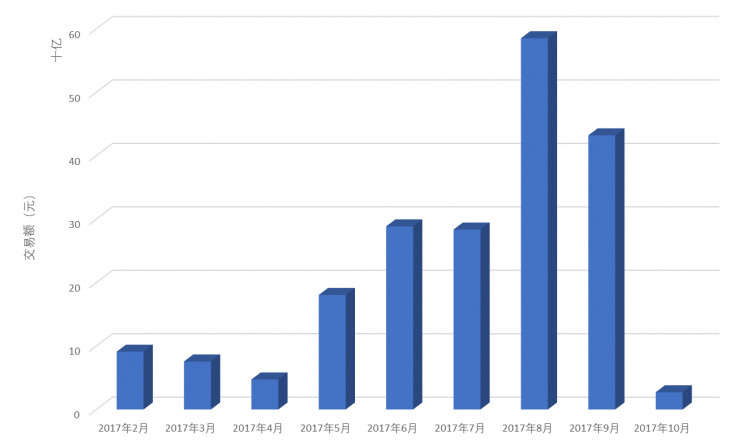

Volume of exchange trading is in opposite trending with OTC trading as shown in Figure 3. OTC trading volume dropped between February and May. Then the volume rose from June to August and declined since September. Current BTC-CNY P2P trading volume is only about 1/100 of the amount of earlier phase.

Figure 3: BTC-CNY exchange trade volume

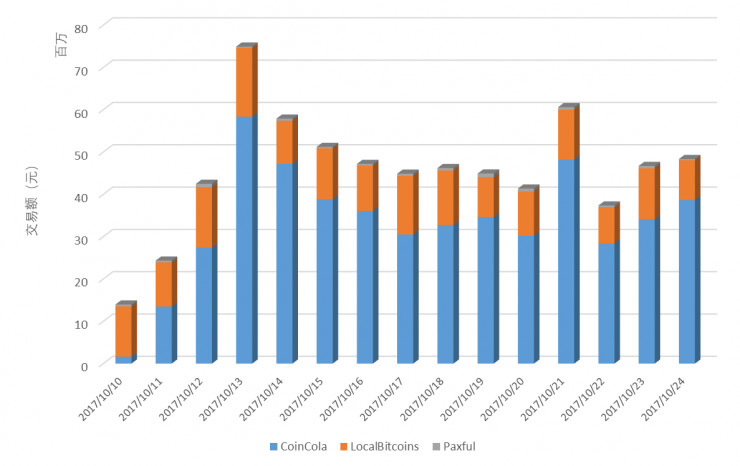

By analyzing the BTC-CNY transaction data of LocalBitcoins, Paxful and CoinCola in the past two weeks, the total transaction volume of the three platforms was 680 million yuan, of which the Hongkong-based CoinCola increased significantly, accounting for up to 70%. The chart below shows the comparison of the turnover of the three platforms in the past two weeks.

Figure 4 Trading volume of OTC Platforms

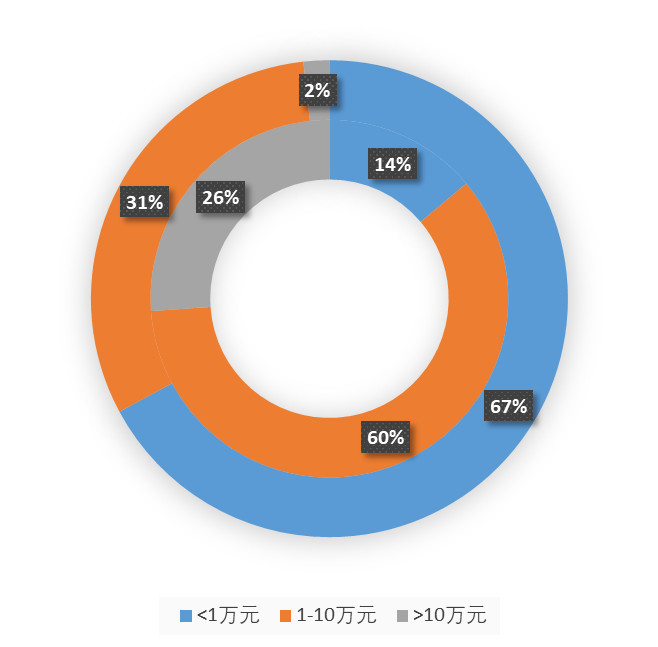

Regarding the size of orders, 67% of the total orders are below 10,000 yuan and accounts for 14% of total amount. Deals between 10,000 yuan to 100,000 yuan accounts for 31% of total orders and 60% of total amount. Only 2% of deals are over 100,000 but they accounts 26% of total amount. The specific distribution is shown in Figure 5.

Figure 5 Distribution of Order Sizes

4. Conclusion

OTC trading is growing day by day with further development of Bitcoin. As OTC trading involves anonymous counterparts, various payment methods and fraudulent transactions, IFCERT will continue to monitor OTC activities.

English

English

Chinese

Chinese

Translation of China Bitcoin and Blockchain news. Opinion is from the original author, not 8btc.

COMMENTS(19)

http://news.8btc.com/vertcoin-price-rallies-while-the-altcoin-market-is-experiencing-a-huge-price-drop …

I am quite sure that this is a solid warning to all governments that if they are planning to act similarly to China, the result is that trading will move ‘underground’, further outside the reach of governments.If you want to maintain some level of control, then make sure you set up proper regulations that to some extent are decent and fair for all involved parties. Governments have to accept that Bitcoin is here to stay.That being said, Chinese exchanges will slowly pop up again, because the governmental actions were not permanent, despite people thinking that China has banned Bitcoin ~ it’s ignorance from the highest levels.

Quote from: BitHodler on October 30, 2017, 12:43:47 PM

I am quite sure that this is a solid warning to all governments that if they are planning to act similarly to China, the result is that trading will move ‘underground’, further outside the reach of governments.If you want to maintain some level of control, then make sure you set up proper regulations that to some extent are decent and fair for all involved parties. Governments have to accept that Bitcoin is here to stay.That being said, Chinese exchanges will slowly pop up again, because the governmental actions were not permanent, despite people thinking that China has banned Bitcoin ~ it’s ignorance from the highest levels.

Correct this is the main reason china re openning the exchanges.I thing India will put some regulation on bitcoin later this year though we donot know yet what they will offer.All other country like usa uk should legalize bitcoin as soon as possible to atleast control it in some way.

Quote from: hl5460 on October 30, 2017, 09:53:46 AM

ConclusionOTC trading is growing day by day with further development of Bitcoin. As OTC trading involves anonymous counterparts, various payment methods and fraudulent transactions, IFCERT will continue to monitor OTC activities.

..and other conclusion: Bitcoin is alive and kicking big time in China, nothing to worry about

Quote from: BitHodler on October 30, 2017, 12:43:47 PM

I am quite sure that this is a solid warning to all governments that if they are planning to act similarly to China, the result is that trading will move ‘underground’, further outside the reach of governments.If you want to maintain some level of control, then make sure you set up proper regulations that to some extent are decent and fair for all involved parties. Governments have to accept that Bitcoin is here to stay.That being said, Chinese exchanges will slowly pop up again, because the governmental actions were not permanent, despite people thinking that China has banned Bitcoin ~ it’s ignorance from the highest levels.

Straight to the point there mate. Chinese bitcoin holders will really find a way to convert/trade their bitcoin because the Chinese choose to closed their local exchanges. Look what happens next, bitcoin was traded underground resulting to losses on the Chinese side. If they thought that closing exchanges will stop Chinese bitcoin holders then they are very wrong. Imagine if those bitcoin goes to their exchanges, its a win win situation for them. So what do they do next? allow local exchanges to operate again? Remains to be seen.

Quote from: junoreactor on October 30, 2017, 01:40:17 PM

Quote from: hl5460 on October 30, 2017, 09:53:46 AM

ConclusionOTC trading is growing day by day with further development of Bitcoin. As OTC trading involves anonymous counterparts, various payment methods and fraudulent transactions, IFCERT will continue to monitor OTC activities.

..and other conclusion: Bitcoin is alive and kicking big time in China, nothing to worry about

Yeah, everything is running normal, its very much alive and kicking underground. Government is too dumb to close local exchanges. Now they are thinking of opening it.Let IFCERT continue to monitor and let them report that a new ATH has been reached next week. LOL. Bitcoin is really here to stay for good and no amount of effort from the government can’t stop this tsunami. China has done everything but it didn’t deter their citizens to continue and enjoy trading bitcoin like there was no hammer ban or strict compliance.

Quote from: BitHodler on October 30, 2017, 12:43:47 PM

I am quite sure that this is a solid warning to all governments that if they are planning to act similarly to China, the result is that trading will move ‘underground’, further outside the reach of governments.If you want to maintain some level of control, then make sure you set up proper regulations that to some extent are decent and fair for all involved parties. Governments have to accept that Bitcoin is here to stay.That being said, Chinese exchanges will slowly pop up again, because the governmental actions were not permanent, despite people thinking that China has banned Bitcoin ~ it’s ignorance from the highest levels.

Couldn’t have said it better, comrade. Although if I do recall, the initial ban never did mean to include OTC and P2P exchanges, which was why I was surprised to see localbitcoins as the only one of their ilk included in the (initial) long list of exchanges ordered to cease operations. We saw how quickly the Chinese got creative and found their ways to get their trading done even via WeChat and Telegram, so we know already that even if they went after platforms, people will just move to apps. And if that gets hounded, they just keep ferreting deeper and deeper.In any case, as you say, the cessation orders were never meant to ban crypto, simply giving them space to begin regulatory measures.If any country is thinking about banning crypto, mining, or exchanges, they better be prepared to lose that battle.

China Bitcoin OTC Report: 100mln USD Traded Over 3 Platforms in Fortnight | http://NEWS.8BTC.COM http://news.8btc.com/china-bitcoin-otc-report-100mln-usd-traded-over-3-platforms-in-fortnight …

Here is the link to the original comment thread. Or you can comment here to start a discussion. Author: 8btccom

中国のIFCERTが今日発表したOTC取引の調査レポート。

香港拠点のCoinColaという取引所での出来高が大半だそうです。

また、10万CNY(170万JPY)以上の取引が全体の26%を占めているそうで、結構大口が多い印象。http://news.8btc.com/china-bitcoin-otc-report-100mln-usd-traded-over-3-platforms-in-fortnight …

Cat’s out of the bag. No putting-it-back-in.

Bye bye China! it was fun!

RemindMe! 3 months “China is back isn’t it?”

If crypto trading in China returns to previous levels (and likely exceed them) we could see another massive bullish wave on majors

Bitcoin OTC Trading #mustreadhttp://news.8btc.com/china-bitcoin-otc-report-100mln-usd-traded-over-3-platforms-in-fortnight …

Quote from: junoreactor on October 30, 2017, 01:40:17 PM

Quote from: hl5460 on October 30, 2017, 09:53:46 AM

ConclusionOTC trading is growing day by day with further development of Bitcoin. As OTC trading involves anonymous counterparts, various payment methods and fraudulent transactions, IFCERT will continue to monitor OTC activities.

..and other conclusion: Bitcoin is alive and kicking big time in China, nothing to worry about

You are right. Money never sleeps.

China is a good example for other states in the sense that even a very large country and the amount of the population could not do anything by prohibiting and restricting the crypto currency. Also, nothing led to the desire of the Chinese government to issue its own centralized crypto currency. In fact, China is just resuming trading in crypto currency, and not inventing anything new. This is a complete victory bitcoin and crypto currency in general.

Quote from: Irvinn on November 01, 2017, 12:32:44 AM

China is a good example for other states in the sense that even a very large country and the amount of the population could not do anything by prohibiting and restricting the crypto currency. Also, nothing led to the desire of the Chinese government to issue its own centralized crypto currency. In fact, China is just resuming trading in crypto currency, and not inventing anything new. This is a complete victory bitcoin and crypto currency in general.

There might be some P2P trading in China. But no exchange is allowed to offer CNY trade.

Quote from: hl5460 on November 02, 2017, 01:57:09 AM

Quote from: Irvinn on November 01, 2017, 12:32:44 AM

China is a good example for other states in the sense that even a very large country and the amount of the population could not do anything by prohibiting and restricting the crypto currency. Also, nothing led to the desire of the Chinese government to issue its own centralized crypto currency. In fact, China is just resuming trading in crypto currency, and not inventing anything new. This is a complete victory bitcoin and crypto currency in general.

There might be some P2P trading in China. But no exchange is allowed to offer CNY trade.

The Chinese National Congress has just concluded a few days ago. There is no confirmed news about the future of crypto in China yet, but the topic has been discussed there. There are rumors about a new crypto exchange run by the Chinese government, for now we need to sit tight and wait for the news to break

30 Oct, Beijing-Right before exit of most Bitcoin Exchanges in China, IFCERT released a report on OTC trade against CNY. Over 680 million yuan worth of trading are observed on 3 platforms in 2 weeks. The report disclose statistics concerning volume etc. Surprisingly, Coincola, a HK-based OTC platform, accounts for 70% of the trading volume, overtaking localbitcoins and paxful. Below is the full text translation.As an important link in the ecosystem of bitcoin and other cryptocurrency, the exchange between Bitcoin and fiats plays an vital role. Usually, the trading could be divided into exchange-trading and OTC-trading. Bitcoin OTC trading has a longer history than exchange trading. OTC trading does not require a fixed place, a permission-based membership or a strict rules system. In most cases, its peer-to-peer transaction through private negotiation. IFCERT has conducted monitoring work over recent OTC trading and the following report is compiled.1. Types of OTCBitcoin OTC trading could be categorized as follows: online P2P, online B2C and offline trading.1.1 Online P2POnline P2P transactions are generally conducted through LocalBitcoins, CoinCola and other OTC trading platforms. This type of website offers Bitcoin buyers and sellers a platform to exchange information and its model is similar to the Taobao model: buyers and sellers trades BTC based on the information displayed on the platform. The specific flow is as follows.User Registration: Both sides register on the platform and fill in corresponding information, generally they are not required to do real-name authentication.Release trading information (Ads): Both parties publish Buy or Sell information on the platform. The seller must deposit bitcoin to the platform. The platform act as a middleman from the transaction and charge a certain percentage of fee from each successful trade.Trade Lock-in: similar to the Taobao model, the buyer enter a certain amount of Bitcoin that he wish to buy then the platform will freeze corresponding amount of Bitcoin from the sellers balance.Payment: According to the mutually-agreed payment method, the buyer pays the seller and provides proof of payment. There are plenty of payment options: bank transfer, cash remittance, third party payment, gift cards and so on. Alipay, WeChat and bank transfer are the most popular payment option for BTC-CNY trade.Confirm receipt of payment: After confirming receipt of payment, the seller press the release button and the platform automatically releases Bitcoin to the buyer.1.2 Online B2C TradeUsers can buy or sell Bitcoin directly with the platform. Bitcoin price is specified by the platform. After receiving the users payment, the platform will directly release Bitcoin to the buyers account. Or release funds to the sellers account after receiving Bitcoin. Bitcoin or funds on the B-side funds are from the platform or cooperative partners.1.3 Offline TradeBuyers and sellers negotiate online or offline through online chat tools such as QQ group, wechat group, Telegram group, Slack group, or face to face talk.2. OTC trading platformAfter the regulatory policy was released in September, domestic OTC platforms like Bitkan and BTCT gradually exited the market. At present 4 OTC platforms that domestic users used most frequently are all located abroad. They are LocalBitcoins, Paxful, CoinCola and BitcoinWorld. OTC platforms are often not an subject to national boundary, which means they are open to all users in the world. For example, LocalBitcoins was founded in 2012, supporting 248 countries, and has users from more than 15,000 cities, including RMB users.In terms of CNY payment methods among CNY dealers, the monitoring results show that since 2017, 96.3% of the BTC-CNY tradings on Paxful are paid via Alipay with 2.7% by WeChat and 0.56% by Itunes gift card. A sample monitoring on LocalBitcoins found that 57% of the sellers chose payment by Alipay, followed by bank transfer, accounting for 28%. Similar monitoring in CoinColas found that 85% of the sellers chose payment by Alipay, followed by bank transfer, accounting for 12%.3. OTC Trade VolumeThe scale of BTC-CNY OTC is shown in Figure 1 (data from LocalBitcoin and Paxful). It can be found that OTC trade volume before February 2017 is relatively small. After the exchange banned bitcoin withdrawal in early Feb, the trading volume grew exponentially. Then the volume dropped as exchange allowed withdrawal after June 2017. With the ICO ban and policy change in early September, OTC transactions once again prosper. From the data of LocalBitcoin and Paxful, the ratio of BTC-CNY volume rose from 5% to 20% among the total volume, which is shown in Figure 2.btcotcreport1Figure 1 BTC-CNY Daily Trading Volumebtcotcreport2Figure 2 BTC-CNY OTC trading volumeVolume of exchange trading is in opposite trending with OTC trading as shown in Figure 3. OTC trading volume dropped between February and May. Then the volume rose from June to August and declined since September. Current BTC-CNY P2P trading volume is only about 1/100 of the amount of earlier phase.btcotcreport3Figure 3: BTC-CNY exchange trade volumeBy analyzing the BTC-CNY transaction data of LocalBitcoins, Paxful and CoinCola in the past two weeks, the total transaction volume of the three platforms was 680 million yuan, of which the Hongkong-based CoinCola increased significantly, accounting for up to 70%. The chart below shows the comparison of the turnover of the three platforms in the past two weeks.btcotcreport4Figure 4 Trading volume of OTC PlatformsRegarding the size of orders, 67% of the total orders are below 10,000 yuan and accounts for 14% of total amount. Deals between 10,000 yuan to 100,000 yuan accounts for 31% of total orders and 60% of total amount. Only 2% of deals are over 100,000 but they accounts 26% of total amount. The specific distribution is shown in Figure 5.btcotcreport5 Figure 5 Distribution of Order Sizes4. ConclusionOTC trading is growing day by day with further development of Bitcoin. As OTC trading involves anonymous counterparts, various payment methods and fraudulent transactions, IFCERT will continue to monitor OTC activities.http://news.8btc.com/china-bitcoin-otc-report-100mln-usd-traded-over-3-platforms-in-fortnight

Please sign in first